The Earlier The Better - IRA Deadlines and Why It Matters To Contribute Early

02/21/2025

With contributions, timing matters. Learn why you shouldn?t wait until the last minute to contribute and why today?s rate environment makes it an ideal time to consider opening IRA CDs.

10 Essential Tips to Prevent Identity Theft and Protect Your Finances

01/30/2025

At Seattle Bank, protecting your personal and financial information is one of our top priorities. This week we?re advocating for Identity Theft Awareness Week, Jan 27-31, and want to share practical tips to help you stay vigilant and reduce your risk of becoming a victim.

Financial Housekeeping: 10 Items to Clean Up at the Start of the Year

01/15/2025

Early January is a common time to prepare for the year ahead by tackling financial housekeeping tasks. Here are 10 financial housekeeping tasks to help kickstart your clean up.

Protecting Yourself Against Business Email Fraud

11/12/2024

Business Email Compromise (BEC) is a costly cyber threat targeting both individuals and businesses by sending fraudulent emails that appear to be from trusted sources, like colleagues or vendors, to trick recipients into transferring money or disclosing sensitive information.

Best Practices to Safeguard Against Wire Fraud

08/13/2024

In today's digital age, cybercriminals become more sophisticated, and risks of fraudulent activity -- in particular, wire fraud -- rise. Organizations and individuals must stay vigilant and adopt robust preventive measures.

What Are The Different Types of CDs And How Do They Work

04/22/2024

Here's a breakdown of the different types of CDs so you can decide which best fits your needs to reach your savings goals.

Three CD Strategies To Consider To Help Maximize Returns

04/08/2024

Planning a purposeful CD strategy can allow savvy savers to access funds at different times based on when they want to achieve different financial goals. Consider these three CD strategies to help plan your CD funding.

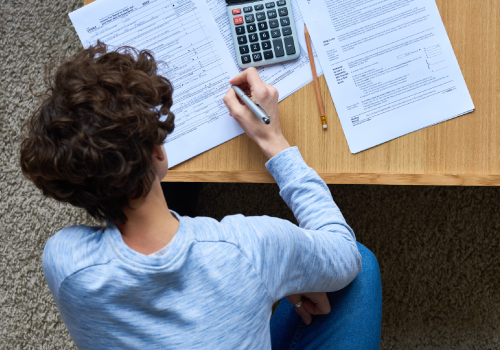

Understanding Tax Implications of Certificates of Deposit

03/25/2024

Learn how CD interest is taxed, how to report it and more to help you prepare for what to expect when filing taxes.

Cybersecurity: High Net Worth Means High Value Targets

04/10/2023

As high-net-worth households increasingly use digital tools to manage their finances and store sensitive data, it is even more critical to strengthen cybersecurity measures to protect assets against hackers.